Summertime and the Living is Easy

At the time of this writing, the S&P 500 and the Dow 30 indices are flirting with record highs…again. The S&P 500 is up a remarkable 18.5%, year-to-date, as of June 30, 2019. The impressive bull market run of the past decade continues to shrug off concerns about trade wars, tariffs, climate change, Middle East tensions, Brexit and whatever the headline of the day is. Hang on, let’s check…the headline in the Wall Street Journal is that Fed Chairman ‘Powell Says Outlook Hasn’t Improved, Setting Stage for a Rate Cut’. Wait…what? Why cut rates?

The unemployment rate is near historic lows at 3.7%, according to the Bureau of Labor Statistics website. That same website reports that the Consumer Price Index (CPI) for all items, less food and energy, rose at a rate of 2%, not seasonally adjusted. The CPI index is commonly used to measure inflation. The Fed’s ‘target rate’ for inflation has often been reported as 2%, so we are right on target.

The Fed has two primary mandates – keep unemployment and inflation in check, or as amended in the Federal Reserve Act of 1977, to promote maximum sustainable employment and price stability. Check and check. We are on track. The primary tool that the Fed uses to achieve these mandates is to set the federal funds rate by adjusting the rate at which it lends money to the banking system. That rate is currently set at 2.39%.

Why would the Fed cut rates if everything seems to be on track? They are telling us that they see something in the global outlook that could present a challenge to our continued economic expansion. For example, the historically low unemployment rate has not resulted in wage growth. People are employed, but they are not able to demand higher earnings, so that is not pushing inflation higher. That could change. Also, the Fed is concerned about the economic impact of tariffs and trade wars, and recognizes that those tensions, if not resolved, jeopardize continued growth.

It is worth noting that the Fed is signaling a rate cut but will not announce what, if any, the rate cut will be until it meets again at the end of July. Things may still change. It is also worth noting that none of these actions are based on what is happening in the stock markets. The stock markets are considered a leading indicator of the economy. If the Fed’s concerns are justified and global economies decline, we could see companies start lowering their projected earnings estimates, and the stock markets would react pretty quickly. In general, we are always cautious when the market indices are at record highs.

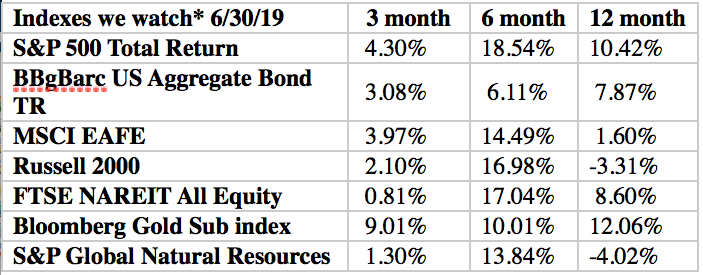

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.