Hindsight is 2020

You knew there was going to be a wordplay on 2020 somewhere in this dialogue, so we thought we would get it out of the way right up front. As we can see clearly now, 2019 was a great year for the markets. We just wish our 2020 vision for the upcoming 12 months was a little less cloudy.

The combined impact of record low unemployment, low inflation, favorable corporate taxes, low energy costs and easy monetary policy proved to be enough to overcome a slew of uncertainties this past year. Despite tariffs, trade wars, a continuing Brexit debacle and even an impeached President, the fundamental strength of the US economy and an optimistic consumer spender would not be denied.

As we look ahead to 2020, we see additional headwinds to face. Healthcare for an aging population; poorly funded Medicare, Medicaid and Social Security programs; a looming Senate impeachment trial and Presidential election; geopolitical tensions that are bordering on open warfare – these are all potentially disruptive to the economy. We can take heart in the fact that we overcame a lot of obstacles in 2019 and can celebrate a strong year of returns, but we need to be cognizant of what lies ahead and not get careless regarding our exposure to risk.

On a more concrete level, 2020 is bringing some welcome changes to the way we can save for retirement. The Setting Each Community Up for Retirement (SECURE) legislation was passed into law and became effective January 1, 2020. This will impact qualified retirement plans, like 401(k) plans, and personal savings plans. For example, Required Minimum Distributions (RMDs) from an IRA have been delayed to age 72. Also, there is no longer an age limit for individuals with earned income to make contributions to their traditional IRA. We are exploring ways the SECURE Act may benefit our individual clients, small business owners and our corporate clients. Please contact us if you would like more information.

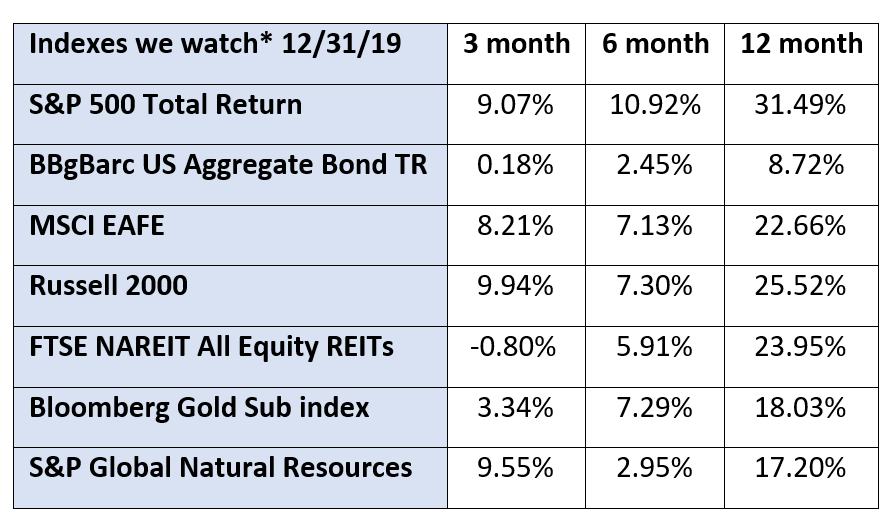

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.