Rapid Refund

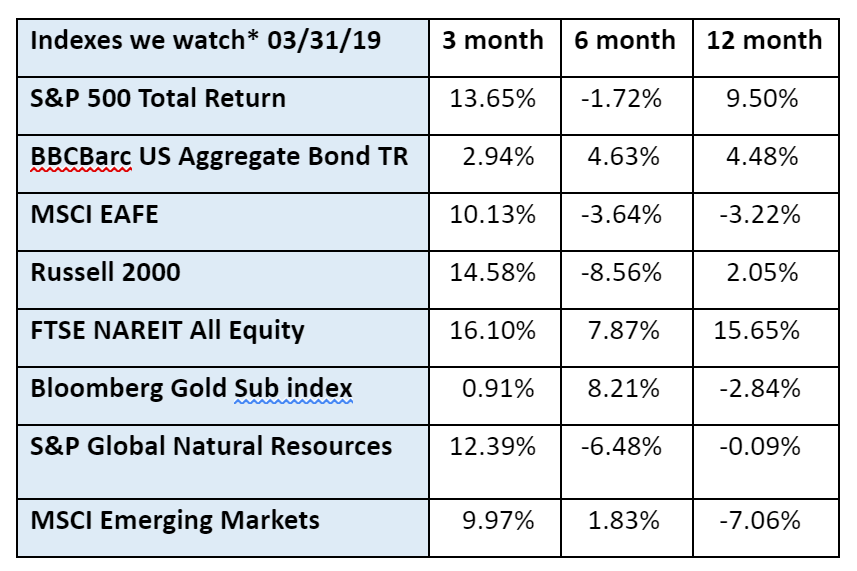

Forgive us for shamelessly borrowing a well-known income tax advertisement, but it is the season for taxes, and the stock markets gave us something of a Rapid Refund in the first quarter of 2019. As shown in the chart above, virtually every asset class started the year strong, shaking off much of the decline suffered in the fourth quarter of 2018. As Mary Poppins taught us, ‘Well begun is half done!’ Let’s hope this holds true for investing this year.

The International Monetary Fund doesn’t seem to be overly optimistic. It cut its forecasts for 2019 global economic growth to 3.3% this week. The IMF forecast was 3.7% last October. This is a significant reduction. They cut their projections for Germany, Italy, Mexico, Latin America and the Middle East. The IMF projects US growth to be 2.3% in 2019 and 1.9% in 2020, down from 2.9% in 2018. This despite Fed Chairman Powell saying recently that the US economy is ‘in a good place.’ In truth, achieving a 3.3% global growth rate would be a good thing. It would indicate that the global economy as a whole is ‘in a good place.’

A quick word on up and down markets – losses hurt more than gains help a portfolio. For example, if a portfolio valued at $100,000 goes down 50%, it loses half its value and is only worth $50,000. A 50% gain from $50,000 will only make the portfolio worth $75,000. It needs a gain of 100% to recover all its lost value. We are using an extreme example of losses and gains to make the math simple and to drive home the point. Losses hurt more than gains help.

That is why we choose to diversify our portfolios to help mitigate the risk of losses. By investing across a range of asset classes, we can offset the impact of declines in a single asset class. The returns of the portfolios are not as high as the best performing asset class in good times, but they are not as bad as the worst performing asset class in bad times. This approach can make it easier for investors to stay in the market over the long term.

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.