Throwing Out The Baby With The Bathwater

The expression ‘Don’t throw out the baby with the bathwater!’ is one of those great old expressions that hasn’t lost it’s meaning over the centuries, even though we are long past the days of actually throwing out bathwater, and hopefully well past the time when water could be so dirty that you could lose a baby in it. Today, we simply open the drain and we are left holding a nice, clean, happy baby. Progress!

At Bryant & Brannock, we are feeling a bit like that baby in the dirty bathwater. The extreme polarization of our political parties is putting us in a dangerous situation. Republicans and Democrats agree (correctly, in our opinion) that additional stimulus is critical to continue our tentative economic recovery. There are some encouraging signs, but small businesses and individuals need to buy time to get through this pandemic. Unfortunately, the parties seem to have each concluded that compromising on a stimulus package will hurt their chances to win in November. This is baffling! Our representatives in government are putting their allegiance to party ahead of the needs of the country. Regardless of your political leanings, this is a disappointing time for Americans. We are a great nation. We are better than this!

In the short term we continue to see outperformance in Large cap Growth stocks, driven almost entirely by the Technology Sector. 2020 has seen the stock prices of Amazon, Apple, Alphabet, Facebook, Netflix, Microsoft and other tech stocks soar to levels that we are not comfortable with. How much value will these stocks be able to hold onto once the pandemic passes? On the flip side, the Russell Large Cap Value Index, , which represents Large cap Value stocks, is down -11.58% year to date. The Russell 2000 Value index, which reflects small and mid cap stocks, is down an alarming -21.54% year to date. We believe these stocks more accurately reflect the current health of our economy in the midst of this pandemic, which is why we believe another stimulus is desperately needed.

The health crisis will pass. We can be certain of that. We are less certain of when it will pass or what things will look like on the other side. Will the tech stocks ‘grow’ into their current high stock valuations? Conversely, will the price of value stocks revert to their mean? When it happens (if it happens), this shift could happen quickly. Our portfolios have exposure to tech and we are happy to share in those gains but we can’t justify jumping completely onto the tech bandwagon. We think it is prudent to keep a diversified approach, even though it may not seem ideal in the short-term.

The election looms large. The outcome will have consequences. The timing and availability of a vaccine for Covid will impact global commerce in unpredictable ways. A stimulus should be inevitable, but we don’t know what form it will take. The strength of our economy going into this year gives us reason to be optimistic, but the shadow of the global pandemic still casts a long shadow.

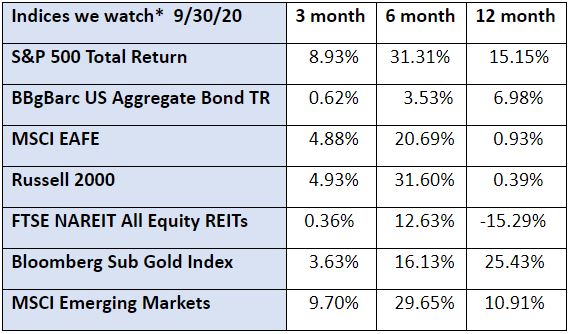

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.