Hey, 2020, Watch This!

As we sat in the Covid-friendly environs of our living rooms on December 31, 2020, and quietly raised a toast to the new year, I am sure we were not alone in bidding a heartfelt farewell to 2020. It felt good to put the preceding 12 months into the rearview mirror. Briefly. Two weeks later, and 2021 looks like it is trying to outdo 2020 in sheer, catastrophic intensity. The old joke about Bubba’s famous last words comes to mind – ‘Hey, boys, hold my beer and watch this!’

We think we have reason to be optimistic going forward, despite a rough start. The Fed continues to signal that they will keep interest rates low through 2023. The next stimulus package is likely to be bigger than the last one. There are two coronavirus vaccines already in distribution and at least two more vaccines in the works. Unfortunately, widespread vaccinations have not gone according to schedule. Hopefully, communities are learning and adapting to make the process more efficient. The sooner we can get the vaccines into the arms of the public, the better. All in all, we see light at the end of the tunnel.

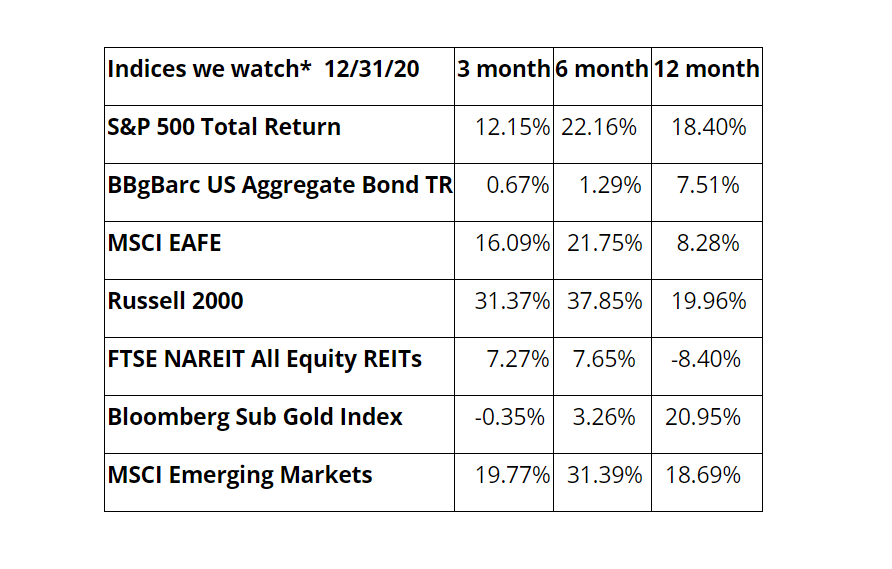

Others see it, too. The Russell 2000 index, which reflects the performance of small-cap and mid-cap stocks, was up over 31% in the fourth quarter. We are seeing the rotation from large-cap tech stocks into the smaller companies that were hit hardest during the pandemic. It is still early, and if we run into more setbacks and lockdowns due to the pandemic, this could be premature, but it is a sign that investors are optimistic. It remains to be seen if the large-cap tech giants that did so well during the pandemic will be able to hold onto their high valuations once the world shifts into a more normal way of life. Will people continue to work from home? Has online shopping become the norm? When people plan their vacations this year, will they fly or drive to their destination? Stay at hotels or rent houses? Eat out or have their meals delivered? We have made myriad adjustments to our routines to cope with Covid. How we choose to come out of it will impact the economy, the stock markets and individual companies in different ways.

There are opportunities for growth in 2021. We like small-cap stocks, particularly value stocks. We also like the potential for growth in Europe, which is finally on the other side of Brexit, although currently still handcuffed by lockdowns. Emerging markets stand to benefit when global demand picks back up. None of this is certain, of course, but we think there is potential. On the downside, it is hard to be optimistic for the commercial Real Estate sector in the foreseeable future. We think the work from home movement will continue in a meaningful way. Office spaces may no longer be in high demand, particularly in the big cities. If this trend were to continue, it would almost certainly drive REIT prices down. REITs should still offer a competitive yield versus most bonds, but it makes for a more challenging environment.

We are early in the new year, and there is a lot of uncertainty ahead. It is hard to believe, but at this time last year, we had never heard of Covid-19. Today the pandemic factors into every scenario we can think of. While we are optimistic as a whole, we fully expect some surprises in the coming year. We believe that having a diversified portfolio is an effective means of mitigating some of the risk of investing. We may not know exactly what is coming, but a diversified portfolio that is exposed to multiple sectors and non-correlated asset classes helps protect against the unexpected.

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.