The Certainty of Uncertainty

Here at Bryant & Brannock, we subscribe and listen to a diverse set of analysts, economists and institutional investors. They often draw very different conclusions from the same data points and their projections can vary widely. We find the truth of the matter often falls somewhere in the middle ground. In January of this year, a panel of mutual fund managers were asked for their predictions for the economy in 2020. In closing, they were asked the question, “What do you think a potential ‘Black Swan’ event could be this year?” For those not familiar with the jargon, a black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, their severe impact, and the widespread insistence they were obvious in hindsight. In response to the question, a panelist offered a few scenarios and then chuckled and said, “But, the thing is, a Black Swan is something I wouldn’t predict.” While the panelist didn’t identify a global pandemic as one of her Black Swan events, she certainly hit the nail on the head. The world didn’t see this coming, and they were not prepared for it.

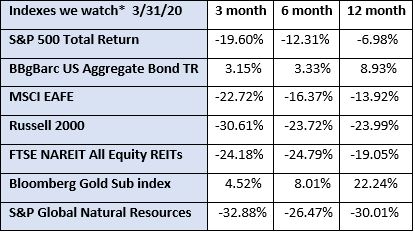

The great Bull Market run-up following the Great Recession of 2008 has finally ended. Most economists agree that we are in another recession now. We officially entered Bear Market territory in March. The last Bear Market occurred between 2007 and 2009 and lasted roughly 17 months. A painful glance at the numbers on the chart above reveals the extent of the declines across the US stock market, real estate market and international markets.

Incredibly, however, even as we write this narrative, some market chartists are claiming that – based on the gains in the stock market over the past two weeks – we have entered a new Bull Market. While we would love for that to prove to be true, we are not ready to pull the curtain just yet. We don’t know yet when the health crisis will peak in this country, and the economic impact has yet to be determined. Health experts suggest we might be at the peak of the contagion this week – but how long does the peak last? Are we in the middle of this thing or towards the end?

In short, we still don’t know what to expect for the foreseeable future, so we have to be prepared for continued uncertainty. For us, that means we will maintain our diversified approach to investing. Domestic and international stock markets took a big hit last quarter. Mid-cap and small-cap stocks, as represented by the Russell 2000 index, were hit especially hard, down -30.61%. The smaller companies felt the immediate impact of diminished consumer demand and rising unemployment. Historically, small cap stocks lead us out of a recession, so we hope that will be the case again. The ‘safe-haven’ investments performed exactly as we would have expected. The US Aggregate Bond index was up 3.15% and the gold index was up 4.52%.

It was a tough start to the year. We take solace in the knowledge that, despite the wide-ranging impact of the Coronavirus Pandemic to our social normality, the various stock and bond markets responded in a harsh but somewhat predictable manner. We are also encouraged by the early reports from other countries that have been able to lift some of their social restrictions.

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.