A Year of Promise

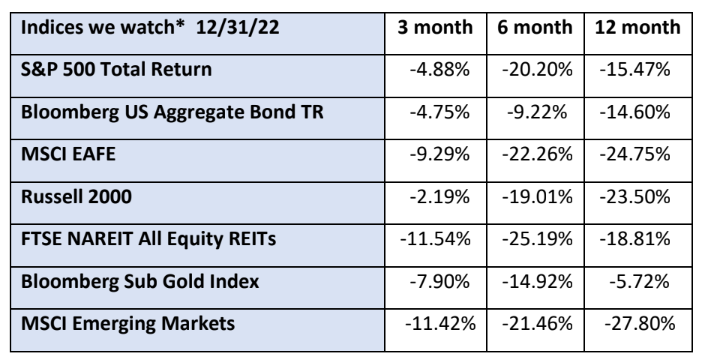

We are currently three weeks into 2023 and, so far, it seems to be carrying some of the positive momentum from the last quarter of 2022. Last year as a whole was brutal, with losses in virtually every asset class, but we did start to see signs of life in the last quarter, as is evidenced by the 3-month column of the above table.

The Federal Reserve has signaled that it may slow down the interest rate hikes this year based on signs that the economy is cooling. Inflation has pulled back to 6.5% for the year, down from a high of 9.1% last June. The Fed has made it clear that there is still work to be done, and they will continue to slow down the economy in order to meet their long-term inflation goal of 2%. We can expect to see more job losses, more interest rate increases and continued pressure on asset prices as the Fed continues putting the brakes on economic growth. This will be painful in some respects but is a necessary step to getting inflation back in line.

Also encouraging, we have seen that vaccines are effective in slowing the spread and severity of Covid. Government lockdowns seem less likely to happen as a result. The impact of the war in Ukraine has become less disruptive to the global supply chain as alternative sources and trade routes are accessed. Here at home, the Fed has demonstrated that inflation can be at least somewhat contained through a tight fiscal policy.

All in all, 2023 is shaping up to be a year of promise. We expect it will be choppy, with a few peaks and valleys, but we believe a diversified approach will keep our portfolios well positioned to find growth where it happens and to help mitigate risk in the downturns.

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.