Casting a Wide Net (and Coming Up Empty)

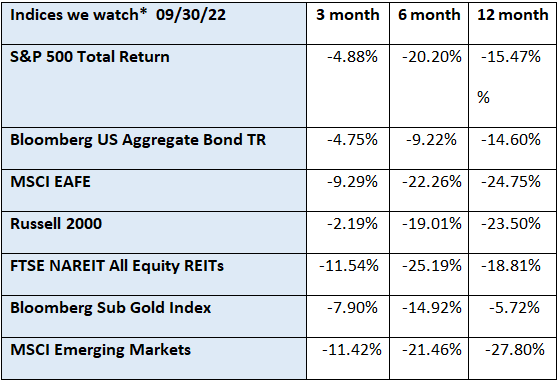

At Bryant & Brannock, we are big believers in diversification. We think it is the most effective and reliable tool we have to help mitigate the risks of investing. We build our portfolios with a diverse set of asset classes and different sectors of the market specifically to limit the possibility that everything will suffer losses at the same time. A quick look at the chart above reveals that 2022 took our investment strategy out to the woodshed.

Time to panic? Not at all. We are not going to toss decades of lessons learned from investing in the market out the window based on one bad year. That would not be wise. However, it is important for us to understand why this happened. Is this a hundred-year storm, to borrow a term from the meteorologists, or is this the new normal? What seems to be the best path forward?

We think it is the former more so than the latter. Here’s why. For brevity’s sake, our rationale will be kept simple and general in nature. Let’s look at the three primary movers in our portfolios – US stocks, bonds and international stocks.

S&P 500 Index – The S&P 500 is perhaps the index most referred to when people talk about ‘the market’. It is comprised of the 500 most widely held stocks based in the US. High inflation, rising interest rates, rising wages, lingering supply chain issues and a pessimistic consumer all contributed to a declining stock market. Since the S&P 500 is a market weighted index, many of the high-flying tech stocks that did so well during the pandemic represent a huge chunk of the index and are now seen as being overvalued. This is a tough environment for companies to make profits in, and ultimately, stock values should be tied to profitable and healthy company spreadsheets.

US Aggregate Bond Index – The decline in bond values has been steep and somewhat surprising. Historically, bonds offer an attractive alternative to equities when the stock market is struggling. However, the Fed has been unwavering in its desire to break the back of inflation and has signaled that it will continue to raise interest rates until it does. When rates rise, it makes newly issued bonds with higher yields more attractive than bonds with lower yields, which pushes the value of those older bonds lower. We have been in a low interest rate environment for about 15 years now, so there is a large inventory of bonds out there that are no longer offering a comparatively attractive yield, some of which have maturities of 10, 20 and even 30 years. The bright side of bonds and fixed income instruments in general is that there are now bonds and CDs offering yields much higher than we have seen for a long time. This is great news for savers. Retirees now have the option to invest their hard-earned money in guaranteed fixed income instruments and receive a decent yield, without having to take on as much risk as is in the stock market.

International stocks – We will combine our thoughts on the MSCI EAFE index and the MSCI Emerging Markets index. The international markets face many of the same issues we face with high inflation, rising interest rates and supply chain concerns, but they are being impacted much more by the war in Russia and Ukraine. It is going to be a tough winter for our European allies due to the disruptions to oil and gas flows. Additionally, the strong US dollar drives up the cost of imported goods abroad. China’s growth has been impacted by its Zero-Covid policy and is becoming increasingly isolated as President Xi Jinping consolidates his grip on the Communist Party. The simmering trade dispute over semiconductor chips reveals how intertwined and dependent nations are on each other for resources and technology. Rather than working arm-in-arm to meet the global need, countries are circling the wagons and trying to build independent infrastructures. This creates a more difficult and less profitable environment and for the companies involved.

We still believe in the merits of diversification. It is clearly not foolproof, but there is value in seeking growth and protection across a broad range of investments. We can’t claim that events won’t line up against us for another hundred years, but we do think that years like 2022 will be outliers and not the norm. For now, we want to maintain our perspective and not overreact to short-term volatility.

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.