A Matter of Timing - Fifteen Years and Counting

People love a good adage. “Don’t put all your eggs in one basket.” “The grass is always greener on the other side of the fence.” “A penny saved is a penny earned.” “An ounce of prevention is worth a pound of cure.” “Strike while the iron is hot.” A good adage must ring true to one’s ears and stand the test of time. One of our favorites, perhaps not as well-known as these others, is “It’s not ‘timing’ the market, it’s ‘time in’ the market that gives you the best chance of success.” We apologize if we have said that last one to you more times than we should have!

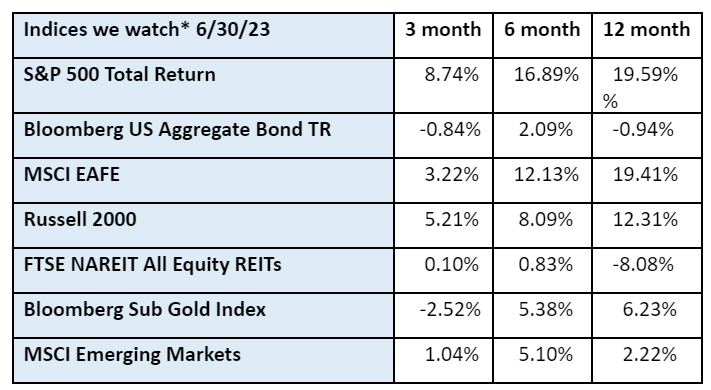

That market timing thing is especially relevant now – for two reasons. The first reason is that we recently went through a real test of trying to time the market. The hyperbole surrounding the debt ceiling debacle last quarter was extreme. Treasury Secretary Janet Yellen issued dire warning after dire warning that if Congress did not raise the debt ceiling it could catapult the US into an economic recession with implications that would last for years to come. The possibility of defaulting on our nation’s debt had everyone on edge – us included. For our younger clients, those with a lengthy time horizon in front of them, our advice was easy. Stay the course, if the market goes south it will recover over time. For other clients, those that are already retired or are nearing retirement, the situation was much more concerning. For some, the risk of staying in the market was simply too much to bear. We moved some folks out of the market. We were, in a sense, trying to time the market. Fortunately, the moment passed. The debt ceiling was lifted and the stock market responded positively to the news, as the chart above attests. Crises averted.

The second reason timing takes on special relevance now is that 15 years ago, in August, Bill Bryant struck out on his own and began Bryant Investment Management Group. If you do the math, you might realize that the year was 2008. The S&P 500 suffered a 38.49% decline. It was a brutal year for the stock market. Bill’s business model went from Plan A to Plan B to Plan C to…there is no plan. Buckle up and hang on tight, this might be a bumpy ride. Throughout it all, he put his clients’ needs ahead of his own and did the work.

Bill was in it for the long term, and he stayed the course and rode it out. Mike Brannock joined his firm in 2010 and we began our partnership, Bryant & Brannock, five years later in 2015. It has been a great partnership for us, and we didn’t want to let this milestone pass without acknowledging it.

We especially want to thank you, our clients, for making it possible. As investment fiduciaries, it is always about you. We put your needs first and foremost. The stock market does not always go the way we want it to. There have been some rough years since 2008, and there will be more to come. We can only control the advice we give, the knowledge we gain and grow from the lessons we learn. As long as we know we are doing the best we can for our clients, we can rest easy and keep our eyes on the road ahead. There is probably an adage that describes this perfectly, but it escapes us. Send us a note if you can think of it.

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.