Bye, Buy Bonds?

Rumor has it that the long bull bond market is over. The Federal Reserve projects that it will continue to raise interest rates. The nation is essentially fully employed. Inflation is creeping op over 2%. The stock market has been hot, even though it has taken a much-needed break recently. As interest rates continue to rise, that will cause yields to increase, and will put negative pressure on bond prices. As yields go up, bond prices go down. So, good-bye bonds?

Let’s not be hasty. Bonds generally move in the opposite direction of stocks. But it is not an inverse relationship, and it certainly doesn’t line up that way if you look at it on a quarterly basis. Bonds can offer much needed stability in a topsy turvy market. We still remember the lessons from 2008 – virtually every asset class was down in excess of 30% for the year – except bonds. The Aggregate Bond Index was up 5%.

We expect to see some losses in the net asset value of bond funds. However, over time, we expect the losses to be offset by higher yields from the new issue bonds bought by the fund. It is tempting to consider moving out of bonds and into guaranteed CDs, or even money market funds. At least they won’t lose value. The concern we have is that we don’t expect rates to rise in a straight line up. We expect it will be gradual, and that it will move sideways or even down from time to time, depending on what is happening in the world. In that environment, the higher yields in bond funds should outperform money markets and short-term CDs.

The uncertain trajectory of the rising interest rates is why we don’t think that moving out of bonds and into cash or CDs is the appropriate solution for all our clients. It depends on your time horizon and circumstances. We welcome the opportunity to discuss it with you.

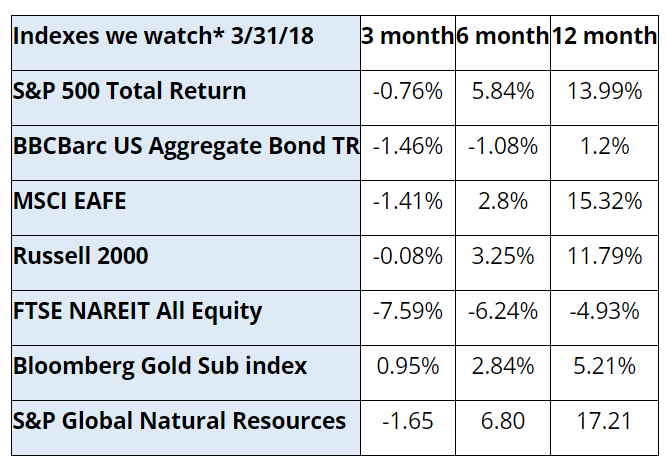

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.