Watching and W(AI)ting

Did you see what we did there? We cleverly inserted AI into waiting. OK, maybe it wasn’t that clever, but it is pretty appropriate considering how AI dominates and permeates our culture and social media, yet relatively few people really understand what AI is, how it works, who is using it or why. We are all kind of waiting to see what it will do next. Despite the uncertainty, investments in AI have been massive, and have powered the stock market to record heights repeatedly this year. The top 5 tech companies – Nvidia, Microsoft, Alphabet (Google), Apple and Amazon currently represent 30% of the S&P 500. It is difficult to determine what the total AI exposure is in the S&P 500, because virtually every company in the index has some investment in AI.

A recent article in the Wall Street Journal, by Steven Rosenbush, (10/14/25) titled “AI Economics Are Brutal. Demand Is the Variable to Watch” focused on the usage of AI as determined by ‘tokens’. Tokens are units of data processed by AI models during training and inference, enabling prediction, generation and reasoning. 100 tokens represent about 75 words. According to the article, in May of 2025 Google estimated that they were processing 480 trillion tokens a month, 50 times more than a year ago. Yes, that is trillions with a T. By July of this year, that number had jumped to 980 trillion tokens. By October the figure had reached 1.3 quadrillion. That is 1,300,000,000,000,000 tokens. And that is usage measured only on the Google platform. That does not include Amazon, Apple, Microsoft, Meta, Nvidia, OpenAI, etc., or the US Government. The amount of energy and processing power required to fuel AI is staggering, and it appears to be expanding at an incredible rate.

We do not know how AI will change our daily lives, but it is clear that AI is here to stay. What does that mean for investors? As we saw with the dot.com boom, not all the players will be winners in the long run. Some will survive, and their trillions of dollars of investments will pay off. Others won’t, and they will pay a very steep price for failure. That is why the big 5 are investing so heavily in AI now. They don’t want to get left behind.

Not all industries will be dramatically changed by AI, and not all sectors of the economy will be impacted in the same way. Proper diversification will be an important tool to help reduce volatility and mitigate risk in investing. The economy has continued to show strength with low unemployment at 4.3%. Inflation came in at 3%, which is still higher than the 2% goal, but it has been fairly stable at that rate. Social Security recipients will get a raise of 2.8% in 2026. Bond yields have declined some but are also staying fairly stable. All of this despite a government shutdown and a toxic political environment at home and abroad.

So we stay diversified in our investment strategy, keep a watchful eye on the markets … and w(AI)t.

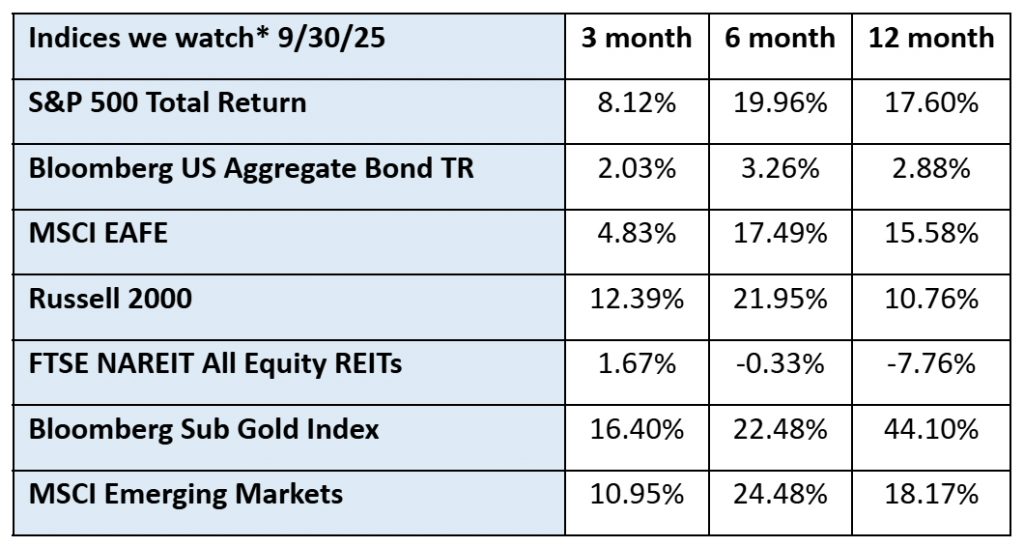

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.